Where is the global economy heading in 2019?

By Christopher Dembik, CASE Fellow

One of the main difficulties in economics is to identify turning points in the business cycle. The notion of Credit Impulse tries to solve this issue by focusing on the evolution of the flow of credit. CASE publishes a quarterly update on Credit Impulse for the main global economies and Poland.

Credit Impulse is a relatively new concept based on basic Keynesian economics that emerged in the aftermath of the Global Financial Crisis and is a key driver of economic growth. Traditionally, economists tend to focus purely on the stock of credit and misses the developments in the flow of credit that are also important to assess the evolution of the global economy. Studies point out that credit impulse is a better credit indicator to understand the business cycle, that is closely related to private demand and that works with a lag of nine to twelve months. In a simple model of economy, the driving forces behind economic growth are consumption and investment. If we assume they are financed by new credit, the best credit indicator related to economic activity is the change in the flow of new credit and not credit outstanding. As the flow of loans is increasing, spending is likely to continue to grow and to fuel economic activity. On the contrary, decelerating credit impulse will produce slower economic activity and negative credit impulse will tend to lead to sharpest slowdowns.

Growth and trade are faltering

The most salient features of 2018 were the end of synchronized global growth, the failure of the reflation trade and a more volatile market environment due to rising populism and the end of accommodative monetary policies that supported financial markets and fueled growth for years. Looking ahead, we are entering a new cycle that will be marked by lower growth, a more fragmented world and higher political risk, particularly regarding the 2019 European elections and the US-led trade war. The underlying trend in global trade growth is probably weaker than the consensus assumes. Current positive headlines mostly reflect frontloading ahead of the implementation of tariffs. The probability is elevated that a sharp slowdown in global trade happens from March 2019 if an agreement is not reached between the United States and China. The risk of US recession, which is more and more mentioned by investors, struggles to materialize. Leading indicators confirm the end of the cycle but no imminent risk of recession. The recession probability indicator from the New York Fed – which looks at the difference between 10-year and 3-month Treasury rates – has increased over the past months to 15% but remains way below levels usually reached before recession. It seems that Trump’s fiscal stimulus and financial deregulation managed to prolong slightly the business cycle, but that was done at the price of more imbalances, especially in terms of public deficit.

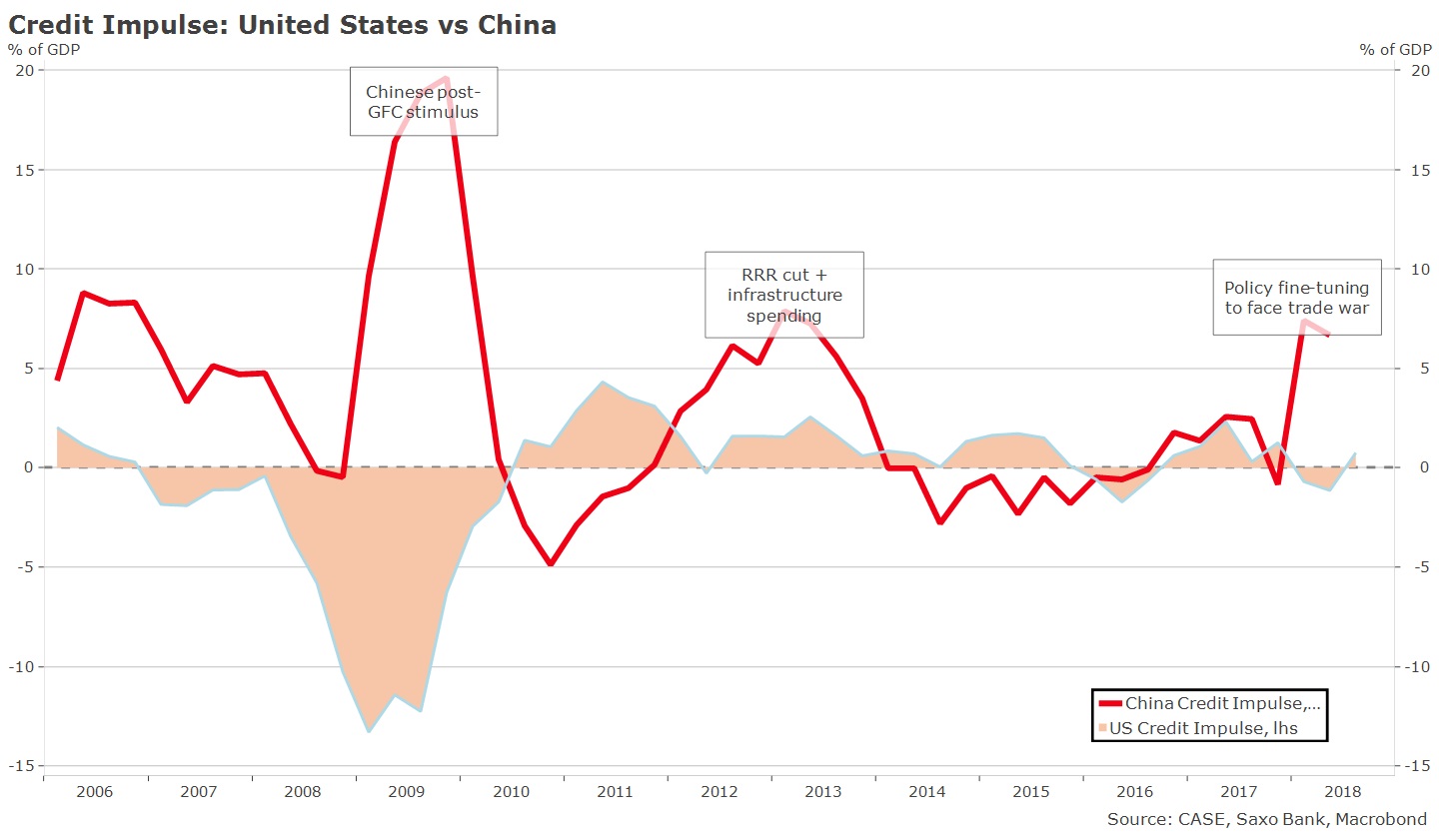

China is opening the credit tap at high cost

China is back as main global credit engine again. Since the beginning of the year, the country has opened the credit tap to mitigate the impact of the trade war. China’s stimulus represents 1/3 of global growth impulse – the equivalent to the combined contribution of the United States and the euro area and is the main exporter of at least 50 countries. China’s credit impulse has been revised upward, at 7.4% of GDP in the previous quarter, and is currently running at 6.6% of GDP. The amplitude of the stimulus is similar to that of the period 2012-2013 when China also implemented RRR cut and infrastructure spending to support the economy. We expect that credit impulse will remain strong in coming quarters as China’s core focus will be growth instead of deleveraging. However, a massive fiscal and monetary stimulus is out of the table given that policymakers worry about the RMB’s stability and that massive credit expansion is less efficient than in the past – China needs four more debt to create one unit of GDP than a decade ago. Our central scenario is based on a fine-tuning policy including RRR cut and tax cuts in Q1 2019, especially an individual income tax reduction and tax exemptions for SMEs and high-tech companies.

Country-by-country analysis: Heading for a soft landing

In this update, we would like to focus on three main economies that we pay attention to in 2019: The United States, the euro area and Poland.

The US economy is doomed to decelerate in 2019

First, the United States. Credit impulse is back in positive territory at 0.7% of GDP because of strong demand in C&I loans and leases since the start of 2018 and fiscal-sugar high that fueled GDP growth in the first and second quarters. We expect that C&I loans and leases will move lower in coming quarters, due to higher interest rates and increasing pessimism, ultimately leading to low credit impulse. Overall, the US economy remains quite strong, and probably stronger that most expected when President Trump took office. However, we notice two weak spots – US housing and car sales - that will have negative influence on consumption and will push GDP growth lower in 2019, likely below 2% YoY. Consumer sentiment index is at a high point, helped by lower oil prices, but based on the spread between the University of Michigan Consumer Expectations and Current Conditions, US households have never been that pessimist about the future since 2006. Bearish signs on the economy are accumulating that will push the Federal Reserve to adopt a wait-and-see stance in most of 2019 and even longer if the outlook deteriorates further, at the domestic or global level.

Germany’s slowdown weights on eurozone growth

Second, the euro area. Credit impulse is down again, at 0.4% of GDP due to low credit generation in a context of monetary policy normalisation. This level indicates clearly that a new and more restrictive cycle has just begun that will lead to lower growth and disappointing domestic demand. Looking at M1, which leads domestic demand by one year, we have another strong confirmation that it will decelerate further next year. Ongoing Eurozone slowdown is undeniably linked to low credit impulse but also to Germany losing momentum. In Q3 2018, the country printed negative GDP due to more pessimism about trade and difficulties of its car industry to move forward into the EV segment and to cope with the drop in the global car market. Recent Q4 data, including IFO report, tend to confirm that the slowdown will last more than the consensus believed. The dominant car industry, that represents roughly 14% of GDP, will take longer to recover from a slump. Credit generation is not encouraging neither. Credit impulse is down at 0.6% of GDP versus 0.9% in the previous quarter. We expect that the slow finish to 2018 will depress German full-year growth this year and weight on eurozone growth. If confirmed, it will have deep implications on the ECB monetary policy, pushing the central bank to adopt a dovish stance in a more challenging macroeconomic environment and postpone a first hike to after Autumn 2019.

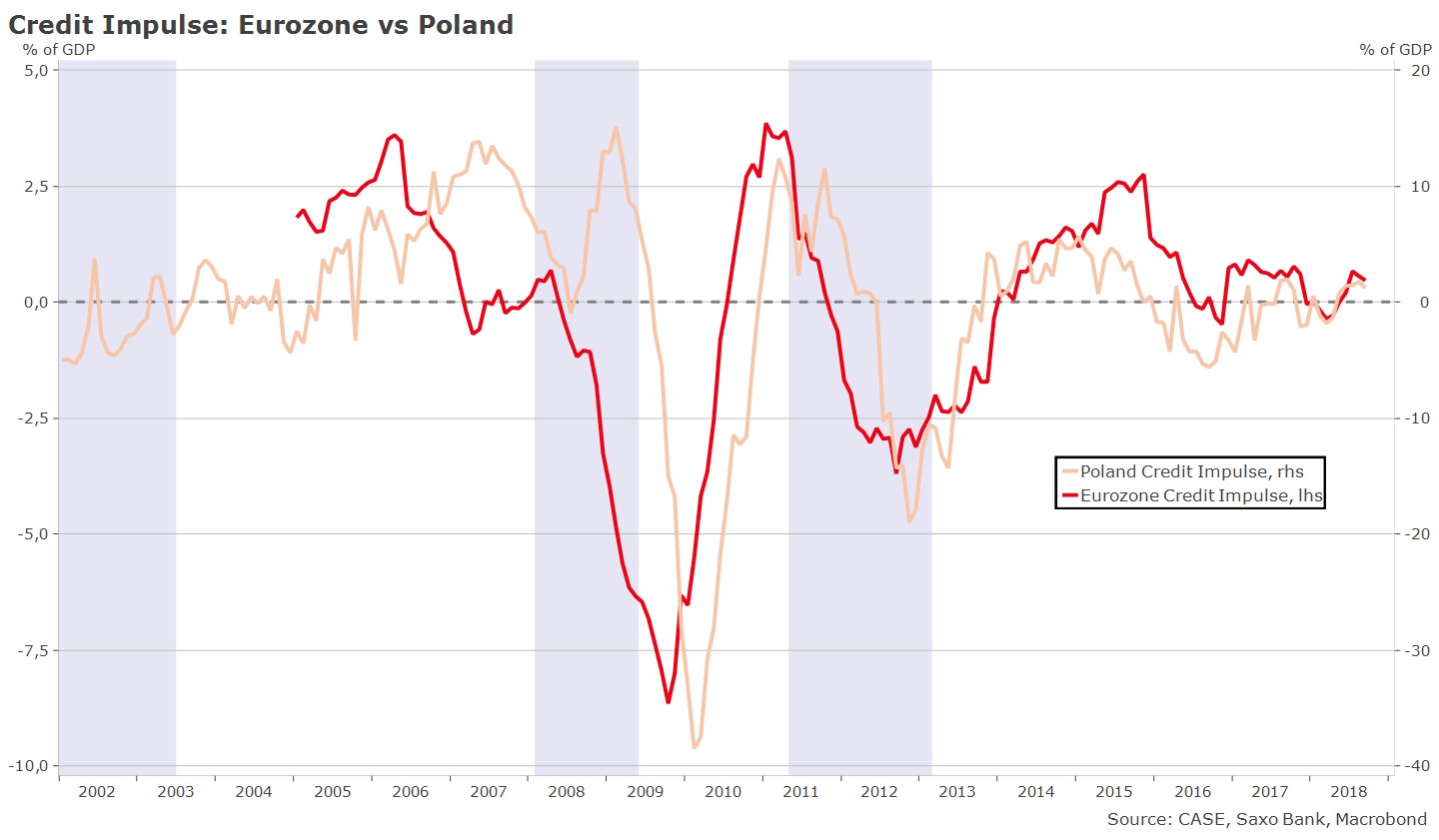

Poland needs to get ready to face the storm

Third, and finally, we cover Poland. Credit Impulse is decelerating at 1.2% of GDP (a level above that of the Eurozone) after reaching 1.3% in the previous quarter. GDP growth has been well-oriented over the past years due to a two-year period of strong credit growth from 2013 to 2015 that fueled private investment and consumption. So far, Poland has confirmed his status as one of the fastest growing economies in Europe. Most recent data published in Q3 2018 confirm this assertion. Poland’s GDP grew by 5.1%, investments increased by 9.9% and private consumption by 4.5%. Investments look impressive, but the bottom line is that it has been largely driven by the public sector in recent quarters. In 2019, decreasing debt/GDP ratio, strong labor market and lower expected inflation due to low oil prices should support consumption and create a positive domestic environment. Headwinds will mostly come from abroad, Germany as mentioned earlier, but also China’s slowdown, and finally the ECB normalisation process. All of that will lead to lower GDP growth. In this context still favorable, it is likely that the NBP will keep financing conditions loose for most of 2019, enabling credit impulse to be higher than that of the Eurozone. However, exit from accommodative monetary policy at the global level may create turmoil for EM countries, as it has happened during past Summer. The risk for 2019 is more concentrated on the zloty exchange rate, that could go lower due to higher risk aversion, than on GDP growth.