Poland’s VAT Gap may widen to above 14.5% in 2020

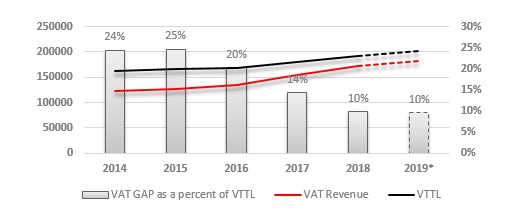

As a result of the recession driven by COVID-19, the 2020 VAT gap in Poland may widen by about 4.9 percentage points from the previous year, reaching ca. 14.5% of the VAT liability. After a period of gradual narrowing, the shortfall may increase beyond the value estimated for 2017 of 14.3% (see Figure 1) and beyond the EU level of 13.7% (EUR 164 billion), according to forecasts from the newest CASE report, Study and Reports on the VAT Gap in the EU-28 Member States, prepared for the European Commission.

The COVID-19 pandemic has not only significantly reduced economic growth in EU member states (according to Commission estimates, Poland’s economy will shrink by 4.6% in 2020, and the EU’s by 7.4%), but has also negatively affected VAT collection and the total tax take.

“The drop in economic activity and difficulties with liquidity are contributing to problems for many companies in meeting their tax obligations, and may simultaneously strengthen the incentives to ignore tax regulations,” said Dr. Grzegorz Poniatowski, director of fiscal policy studies at CASE, who led the team that prepared the report.

The 2020 data in the report are forecasts, while the 2019 data are based on a simplified estimation model. In light of delays in data availability, in the report we can present full data for 2018, which indicate that Poland’s VAT Gap narrowed by 4.3 percentage points, to 9.9%. According to our calculations, Poland lost almost PLN 19 billion (EUR 4.45 billion) of VAT revenue in 2018. However, we note that after a significant narrowing of the gap since 2015, the pace of shrinking is starting to slow significantly. We estimate that in 2019 Poland’s Gap remained at a level similar to that of 2018.

Figure 1. VAT Gap as a percentage of liabilities, VAT revenue, VAT liabilities in 2014-2018 (millions PLN)

Source: Study and Reports on the VAT Gap in the EU-28 Member States

*the 2019 data in the report are so called “fast estimates”

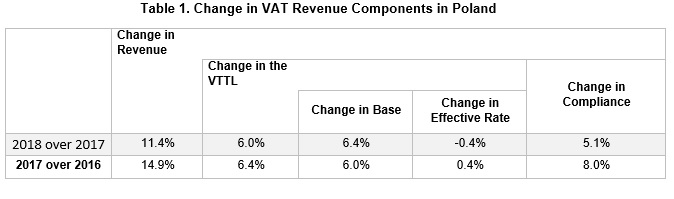

Our report also indicates that VAT revenue grew by 11.4% in 2018 from 2017, thanks to two factors: a 5.1% increase in VAT collection and 6.4% growth in the tax base (comprising consumption and, partially, investment). On the basis of these data we also see that further growth in VAT collection in Poland is increasingly limited (see Table 1. MORE information can be found in the report on page 15).

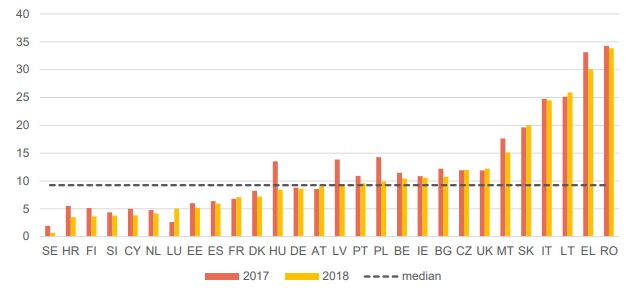

“A significant component of the VAT Gap is the unregistered economy, which will be very difficult to reduce in conditions of global economic problems,” said Poniatowski. “In countries with narrower VAT Gaps, such as Sweden or Finland, the share of the shadow sector in the total economy is definitely smaller than for example in Poland.”

Source: Study and Reports on the VAT Gap in the EU-28 Member States

In 2018 a narrowing trend in the VAT gap was visible in almost all EU countries. A total of EUR 140 billion in VAT went missing from the budgets of 28 EU states (the Gap narrowed by EUR 0.9 billion compared to 2017). In percentage terms, that means a narrowing of the gap from 11.5% in 2017 to 11% in 2018. Preliminary estimates indicate that in 2019 the EU VAT Gap shrank to 9.6%.

The VAT Gap shows the shortfall between VAT liabilities and the true public budget receipts. The VAT Gap is due to a number of factors, including tax evasion, tax avoidance, and fraud that in the EU in recent years have taken the form of VAT carousels, in which VAT goes missing in transactions between companies, using missing trader, and a zero rate applied in intracommunity trade.

Figure 2. VAT Gap in 2017 and 2018 as a percentage

Source: Study and Reports on the VAT Gap in the EU-28 Member States

The VAT gap is estimated using data from national accounts and detailed data from member states. The methodology used was developed and improved over a number of years, and currently the VAT Gap estimate combination is the best in terms of costs and accuracy. The report also includes so called “fast estimates” for VAT in 2019, and the 2020 data in the report are forecasts.

“Study and Reports on the VAT Gap in the EU-28 Member States” was commissioned by the European Commission (DG TAXUD) and written by a team of experts, directed by Grzegorz Poniatowski, and composed of Mikhail Bonch-Osmolovskiy, and Adam Śmietanka.