Is Europe Overbanked?

Since the beginning of the economic crisis in 2008, academics, policy makers, and citizens alike have engaged in discussions about its causes and consequences, and which the appropriate counter-measures should be. The banking system has been carefully and repeatedly scrutinized. However, a broad consensus on the roots of the problem is unlikely to emerge anytime soon.

Since the beginning of the economic crisis in 2008, academics, policy makers, and citizens alike have engaged in discussions about its causes and consequences, and which the appropriate counter-measures should be. The banking system has been carefully and repeatedly scrutinized. However, a broad consensus on the roots of the problem is unlikely to emerge anytime soon.

During the 132nd mBank – CASE Seminar our guest, professor Marco Pagano of the Faculty of Economics at the University of Naples Federico II, took part in this debate. He focused on the question of how the size of the banking system is related to the likelihood and severity of crises, and delivered a presentation titled “Is Europe Overbanked?”

Prof. Pagano approached this question in four steps, similar to those that would be adopted in dealing with a potential medical problem. Firstly – anamnesis: data collection and establishing the current and past properties of the banking system, as well as conducting a comparison between different banking systems. In the second step, diagnosis, prof. Pagano aimed to establish whether the banking system has expanded too much and has become a source of economic instability. Thirdly, in the etiology, he searched for the roots and the course of the illness. Finally, he suggested the therapies that in his view would help to resolve the issue.

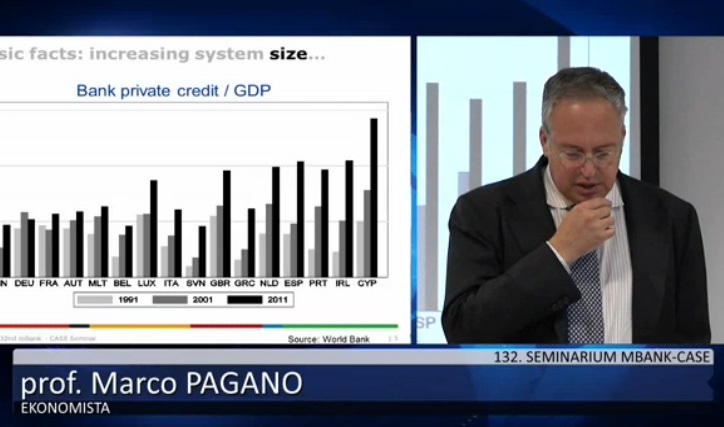

The most important facts that emerged from the process of anamnesis was that the size of the banking system remained relatively stable throughout most of the 20th century, but started to expand in the 1980s and 1990s. The loans to GDP ratio increased significantly, and even more so in the EU than in the United States or Japan.

At the same time, the concentration of the banking system increased, as a small number of large banks expanded disproportionately and took a larger share of total banking activities. These larger banks lowered their leverage ratio (the book value of equity divided by the book value of total assets). As a result, the banking system, and the largest banks in particular, have become larger, and potentially more influential on the general economy, as well as more leverage and thus riskier.

This leads us directly to diagnosis of whether banking sector has expanded too much. Traditionally, it has been commonly believed that the growth of the financial system would promote growth in the economy more generally. However, more recent research indicates that this may be true only up to a certain threshold, after which the marginal value of growth in the financial system becomes zero or even negative, because over-expansion of the financial system promotes misallocation of capital and human resources. At the same time, studies show that banks within large banking systems are more prone to take risks. As a result, in these over-banked systems, risk-prone financial institutions are more likely to cause distress to the general economy in case of insolvency or failure.

In Europe, banks have not only become bigger, but also more “universal” in the scope of their activities. They no longer limit themselves to supplying mortgages to families or loans to companies, but they also deal in securities, derivatives, and other financial products. As a result, they are more interconnected, so shock on the securities market is more likely to reverberate through the credit market too. As such, this interconnectedness facilitates a quick spread of a crisis from the balance sheets of one bank to that of the next, destabilizing the system as a whole.

In the third step – etiology – prof. Pagano established how this situation arose. One important factor is the fact that that European banks received greater state support that their counterparts in US. European governments were more inclined to either bail out distressed banks, or to merge them with more stable national banks, in spite of the concerns that such measures might lead to over-concentration and the lack of competition. Moreover, in Europe the banking system has traditionally occupied a more central position in the financial system than in USA. European countries sometimes support the growth of very large banks to engage more successfully in competition with foreign banks. This in turn increases the political leverage of these banks and their ability to push for favorable policies.

These are the fundamental problems within the European banking system. As such, they cannot be resolved merely by an easy, quick-fix solution. Significant efforts have already been made and various therapies have already been applied. But prof. Pagano claimed that these will not suffice and suggested several measures that would help to improve the situation; reducing the preferential fiscal treatment of debt, striving towards a more aggressive anti-trust policy, and increasing minimum capital requirements would in his view be important steps in the right direction.

These are the fundamental problems within the European banking system. As such, they cannot be resolved merely by an easy, quick-fix solution. Significant efforts have already been made and various therapies have already been applied. But prof. Pagano claimed that these will not suffice and suggested several measures that would help to improve the situation; reducing the preferential fiscal treatment of debt, striving towards a more aggressive anti-trust policy, and increasing minimum capital requirements would in his view be important steps in the right direction.

The video of the seminar is available at Bankier.TV (click here to watch it).

The presentation delivered during the 132nd mBank-CASE Seminar was based on the Report issued by the ESRB Advisory Scientific Committee (chaired by prof. Pagano) in June 2014, downloadable from https://www.esrb.europa.eu/pub/pdf/asc/Reports_ASC_4_1406.pdf

Do not miss our future events - sign up for our newsletter or follow us on facebook.