EUR 147.1 billion in VAT revenues was lost in 2016 in the EU

The total shortfall in VAT budget receipts of the 28 EU members came to EUR 147.1 billion in 2016, according to a recent study conducted by the Center for Social and Economic Research (CASE) for the European Commission.

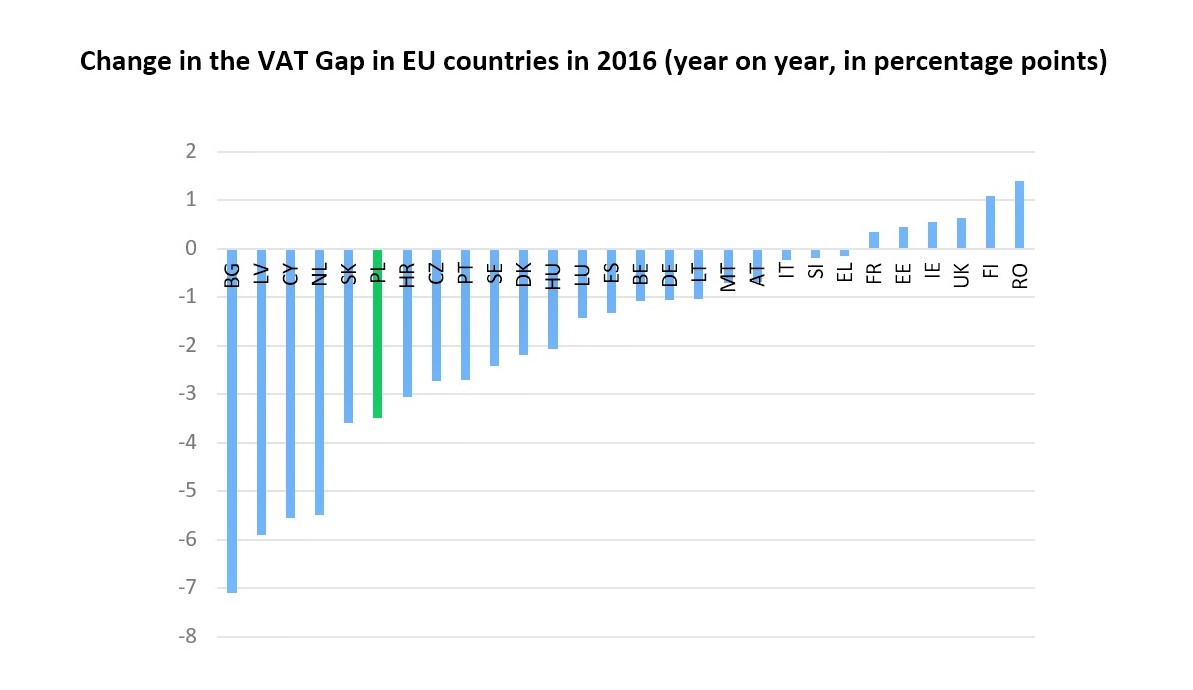

Even though the VAT Gap, i.e. the VAT that is theoretically due but for various reasons ultimately does not reach the state budget, continues to be high, our report shows that for yet another year VAT collection in the EU has improved. In 2016, twenty two EU countries narrowed the VAT Gap.

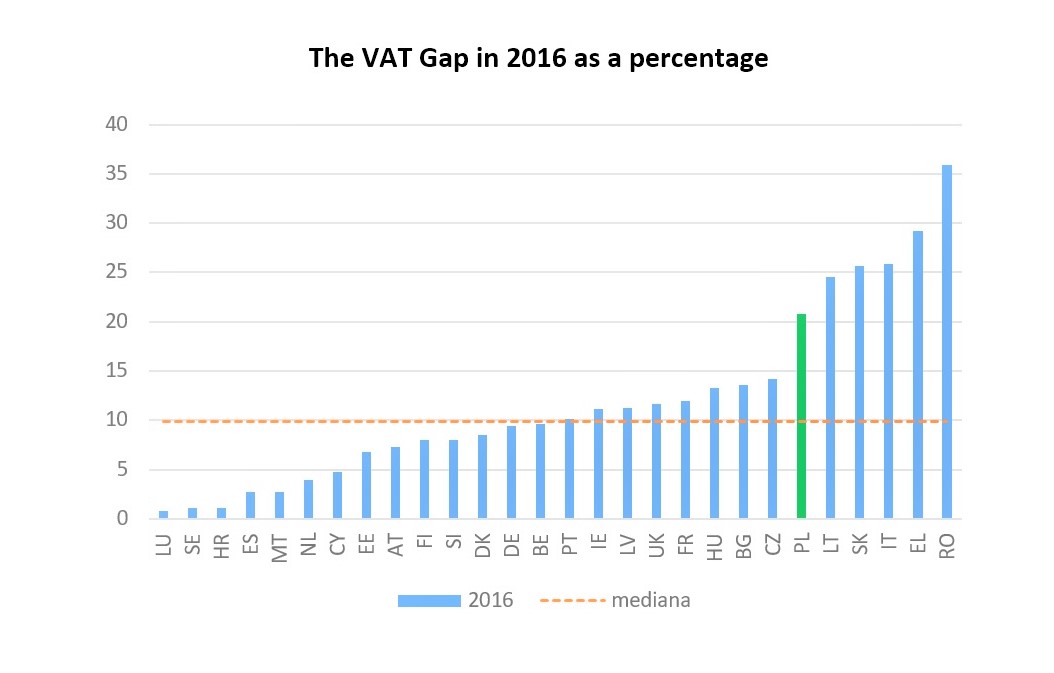

The EU’s VAT Gap was reduced by more than EUR 10 billion on 2015 and more than EUR 20 billion on 2012. Percentagewise, this was a reduction in VAT losses from 13.2 per cent in 2015 to 12.3 per cent in 2016 r. This is the best result attained since 2012, when we published our first study on this subject.

“The higher rate of VAT recovery over the entire EU is a result of an overall improvement of the economic situation in Europe and the fact that the countries have begun taking various measures to stop evasion of VAT and render tax inspections more efficient, for example IT systems that officials can use to quickly review accounting records and invoice data,” says Dr. Grzegorz Poniatowski, Director of Fiscal Policy Studies at CASE, who headed the team that produced the report.

At the top of this year’s ranking were Luxembourg and Sweden, while Bulgaria, Latvia, Cyprus and the Netherlands managed to decrease VAT losses by more than 5 percentage points on 2015.

Meanwhile, the VAT Gap in Romania, Finland, the UK, Ireland, Estonia and France increased. In percentage terms, Romania had the highest VAT Gap (35.88 %), and Italy had the highest percentage share in the EU VAT Gap, as its VAT receipts were down by just under EUR 36 billion.

For the first time, this year’s report contains an econometric analysis of determinants of the VAT Gap. Econometric studies show that the larger the percentage shares of retail trade, telecommunications services, industry, and also artistic activity in the economy, the greater the VAT loss. Another factor affecting VAT receipts is the scale of government administration and the state’s expenditure on computerisation: more investment in these areas usually results in less VAT losses.

“Study to quantify and analyse the VAT Gap in the EU Member States” was commissioned by the European Commission (DG TAXUD) and written by a team of experts, directed by Grzegorz Poniatowski, and composed of Mikhail Bonch-Osmolovskiy, Adam Śmietanka, José María Durán Cabré (University of Barcelona) and Alejandro Esteller More (University of Barcelona).

Read the report: [link]

Read the European Commission news release: [LINK]