China is easing again as global growth is slowing

By Christopher Dembik, CASE Fellow

One of the main difficulties in economics is to identify turning points in the business cycle. The notion of Credit Impulse tries to solve this issue by focusing on the evolution of the flow of credit. CASE publishes a quarterly update on Credit Impulse for the main global economies and, from 2019, it will also include an analysis about Central and Eastern Europe.

|

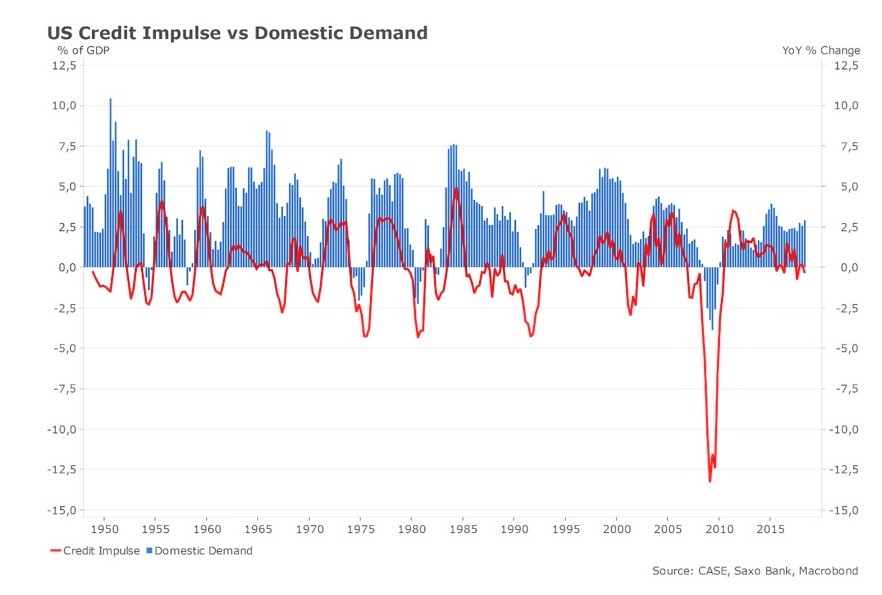

Credit Impulse is a relatively new concept based on basic Keynesian economics that emerged in the aftermath of the Global Financial Crisis and is a key driver of economic growth. Traditionally, economists tend to focus purely on the stock of credit and misses the developments in the flow of credit that are also important to assess the evolution of the global economy. Studies point out that credit impulse is a better credit indicator to understand the business cycle, that is closely related to private demand and that works with a lag of nine to twelve months. In a simple model of economy, the driving forces behind economic growth are consumption and investment. If we assume they are financed by new credit, the best credit indicator related to economic activity is the change in the flow of new credit and not credit outstanding. As the flow of loans is increasing, spending is likely to continue to grow and to fuel economic activity. On the contrary, decelerating credit impulse will produce slower economic activity and negative credit impulse will tend to lead to sharpest slowdowns. |

The goldilocks economy is done. Economic growth is decelerating at the global level as a consequence of lower central bank liquidity injections along with rising political risk, and oil-fueled inflation is jumping, especially in the G7-countries where YoY average inflation was at 2.1% in August 2018 versus 1.6% in August 2017.

Soft landing in developed countries

Fears of a sharp economic slowdown are emerging, and some analysts even mention the possibility of a recession in the United States in 2020. In fact, the global economy has certainly reached its peak of growth in the second half of last year. In developed countries, the economic slowdown has already started but it is not time to worry yet.

Credit Impulse is close to its lowest points in Europe and in the United States. Since it leads the real economy by 9 to 12 months, we should expect worse data from 2019.

- In the euro area, our last update indicates that credit impulse is running at 0.2% of GDP. It is slowly pointing upwards after four quarters of decline, but the picture remains blurred due to lower GDP revisions. In further details, we notice that euro area bank credit flows have been decent over the past summer, but recent setback in Spain and in Italy tend to indicate that there is a desynchronization at work between the core countries and the South of the Eurozone, which could be accentuated with the start of the ECB QE tapering this month. The most problematic country is Italy where leading indicators, notably credit impulse and Bank of Italy’s Ita-Coin, are pointing to much lower growth that will fuel concerns about debt sustainability in coming years.

- Across the Atlantic, the growth trend is slightly stronger. US credit impulse has entered into negative territory again, running at minus 0.3% of GDP, but the economy continues to outperform its potential growth because of Trump fiscal boost and higher business investment that has started to kick off before Trump presidency. These positive drivers are unlikely to last much longer due to trade war and monetary policy normalisation, and we can safely expect that lower credit generation will lead to lower demand and lower private investment. There is a high 0.70 correlation out of one between US credit impulse and private fixed investment and a high 0.60 correlation out of one between credit impulse and final domestic demand. So far, US households are the main weakest points of the US economy. Consumer stress is increasing as a result of higher energy prices and tightening credit conditions. The recent sharp increase in 30-year mortgage rate, that has crossed the 5% threshold, will accentuate the slowdown in housing investment and, ultimately, weight on economic activity.

China credit impulse is changing the global outlook

Since the Global Financial Crisis, there has been only two things that really matter for global growth: central bank liquidity injections and China credit impulse. Since central bank liquidity injections are getting close to zero, the evolution of the global economy is largely dependent on China credit creation as China’s contribution to global growth is approaching 35% (matching that of the US, India and the euro area together).

Despite the US-led trade war, the overall Chinese economy is still performing well but September manufacturing PMI confirms that China is starting to fell the pain: exports orders were the weakest in the past two years and half and YoY real export growth point to flat. As a consequence, since last May, China has decided to ease monetary policy again. Total social financing the broadest measure of credit and liquidity is still decreasing, because of shadow banking decline, but narrow credit data indicates that credit growth in traditional banking has been pushed upward. YoY loans to non-banking financial institutions, which were in negative territory in previous years due to deleveraging, have jumped by 52% last August.

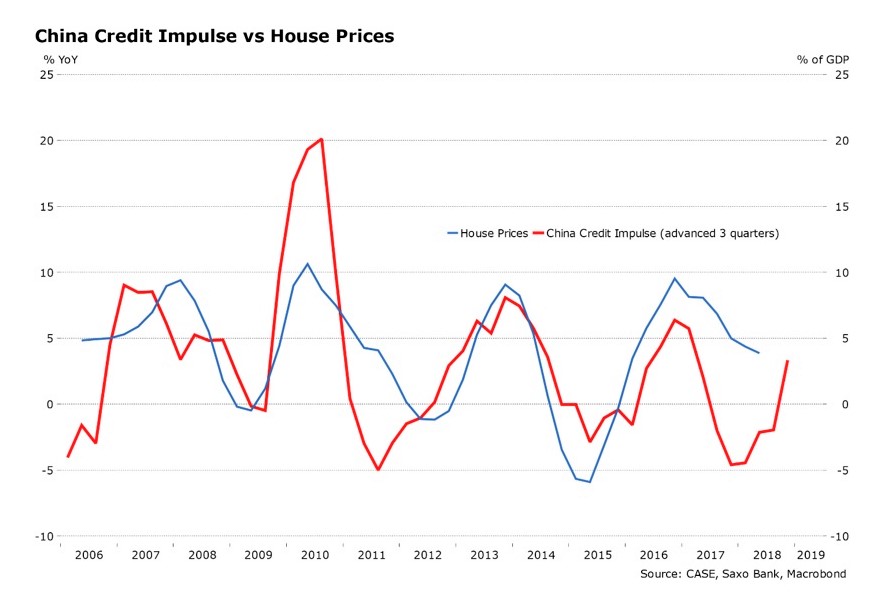

China’s easing monetary policy has pushed credit impulse in positive territory for the first time since the end of 2016. The magnitude of the impulse is still limited. It is running at 3.3% of GDP versus a peak at 20% of GDP in 2009. However, each time China credit impulse was positive, it has strongly helped the local real estate sector, China GDP growth and provided a welcome support to EM markets and the global economy. As credit impulse tends to lead house prices by three quarters, we can expect a real estate recovery will happen in 2019, especially in first-tier cities, where the slowdown was the biggest this year. Since this sector represents roughly 50% of China’s investments, it will ultimately boost economic activity and push higher GDP figures. In contrast, the positive outcome of higher China credit impulse for EM countries and the global economy is more uncertain.

This time is slightly different:

- In previous credit impulse peak in 2009, 2014 and 2016, monetary policy was still very accommodative at the global level, which has certainly increased the net positive effect of the Chinese stimulus.

- China’s support looks like it has come too late and too little. China is willing to help its economy, but it might be reluctant to open too much the credit taps, which could ruin its efforts to cut back on shadow banking.

- China’s economy is less dependent on exports and, thus, more resilient to face trade war than years ago. Exports account for just 18% of China’s GDP, compared with nearly 35% in 2007. China’s economic transformation pushes for the implementation of a fine-tuning policy rather than another 2009-style stimulus.

- No one can know how the trade war will evolve and what will be the real macroeconomic impact. Trade war looks like an overinflated risk compared to lower liquidity and stronger US dollar, but it remains one of the top geopolitical risks on the map.